Car Insurance in the USA

The Best Car Insurance Options in the USA

The Best Car Insurance in the USA: Inside the good-sized expanse of America, in which highways stretch for miles and concrete streets bustle with interest. having reliable automobile insurance isn’t always just a wise choice however frequently a felony requirement.

With such a lot of alternatives to be had, deciding on the best automobile insurance can be a frightening venture. but, several companies stand out for his or her complete coverage, competitive quotes, and stellar customer support.

allow us to discover a number of the top contenders within the vehicle insurance marketplace throughout the United States.

State Farm: A Trusted Name

Kingdom Farm has long been synonymous with reliability and client delight.

With a wide community of marketers throughout the USA, state Farm provides customized carriers alongside some insurance add-on accessories, together with legal responsibility, collision, and comprehensive coverage.

Their sturdy online gear and mobile app make managing policies and submitting claims a breeze.

GEICO: low-cost and green

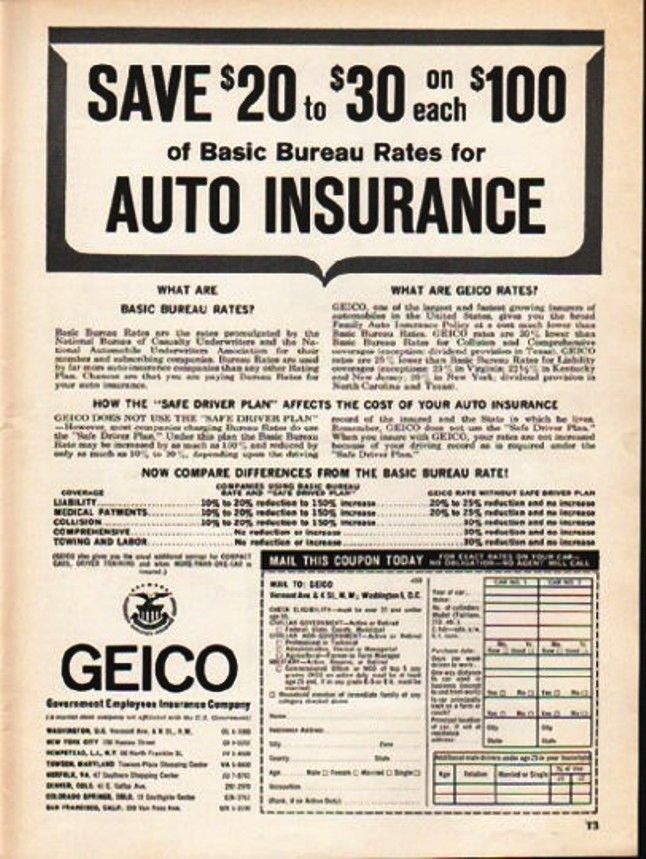

GEICO, recognized for its catchy classified ads featuring a gecko, has built a recognition for offering affordable automobile insurance without compromising on nice.

Their user-friendly website and cellular app make obtaining a quote and coping with regulations tremendously convenient.

GEICO is mainly famous for its aggressive prices and discounts, catering to a huge range of drivers, which include students and navy personnel.

progressive: Innovation and Customization

Modern has carved a niche for itself within the coverage market with the aid of pioneering capabilities and accessories inclusive of utilization-based insurance and snapshot, a program that rewards secure driving behavior.

Their intuitive online quote device simplifies the method of comparing rates and coverage add-on accessories.

Allstate: comprehensive coverage and sources

Allstate boasts a wide range of coverage add-ons. What sets Allstate apart is its emphasis on client education and sources, presenting equipment like the Drivewise software.

USAA: distinct benefits for military participants

For members of the army and their families, USAA stands proud as a tremendous choice.

past providing aggressive fees and comprehensive coverage, USAA gives one-of-a-kind blessings along with deployment and garage discounts.

Their pinnacle-rated customer service and commitment to serving the army community make USAA a dependent insurer for the ones who have served or are currently serving.

Amica Mutual: client-Centric technique

Amica Mutual always earns excessive marks for patron delight, way to its personalized service, and attentive claims coping.

As a mutual insurer, Amica is owned through its policyholders. This means that its recognition stays squarely on serving the desires of its clients in place of shareholders.

With quite several insurance options and reductions available, Amica Mutual affords peace of thought to drivers across America.

Selecting the right vehicle insurance issuer involves thinking about factors along with insurance alternatives, customers and reductions to be had.

whilst the aforementioned organizations are various pleasant within America, it’s vital to evaluate rates and rules to find the first-class match for a man or woman’s wishes and options.

by way of prioritizing reliability, affordability, and patron satisfaction, drivers can hit the street with confidence, understanding they’re included by using the first-rate automobile insurance to be had.

Top 5 car Insurance Companies in the USA

As of my closing replacement in January 2022, the top car insurance businesses inside the United States have been decided primarily based on factors including market proportion, purchaser pleasure rankings, monetary energy, and insurance alternatives. right here are the pinnacle five vehicle coverage organizations:

-

country Farm:

With its extensive community of dealers and extraordinary customer service, country Farm continuously ranks among the various pinnacle vehicle insurance vendors in the US.

kingdom Farm provides a wide variety of coverage options, reductions, and personalized carriers to fulfill the needs of its policyholders.2. GEICO (authorities employees insurance company):

acknowledged for its catchy advertising campaigns and competitive costs, GEICO is a popular choice for vehicle insurance.

GEICO affords convenient online tools for acquiring prices, dealing with regulations, and submitting claims.

The enterprise’s inexpensive charges and diverse insurance options make it a favorite among drivers across the US.

3. Innovative:

modern stands out for its revolutionary approach to vehicle coverage.

Imparting capabilities like utilization-primarily based coverage and photo, which tracks riding behavior to determine discounts.

modern’s consumer-pleasant website and cellular app make it easy for customers to get costs and manage their policies.

4. Allstate:

Allstate is known for its complete coverage options and customized service.

The organization gives a diffusion of coverage products, which include widespread guidelines.

Allstate’s network of dealers provides personalized guidance to policyholders, making sure they have the coverage they need.

The company’s dedication to serving the army network has made it a trusted insurer for generations of service contributors.

How to apply for car insurance in the USA

Determine your wishes: Before diving into the utility system, make an effort to evaluate your coverage needs.

Do not forget elements together with the sort of insurance required through law for your state.

Your finances the cost of your car, and any additional insurance options you would possibly want, which include collision or comprehensive insurance.

Accumulate records:

To streamline the software technique, gather the important records in advance.

This generally includes private details together with your name, date of birth, driver’s license variety, and social security quantity.

You will additionally want facts about your vehicle, together with make, model, year, VIN (automobile identification quantity), and mileage.

Keep around:

With your statistics in hand, it is time to start shopping for automobile insurance.

Research and evaluate rates from multiple coverage carriers to find the great coverage alternatives and costs that suit your desires and price range.

make use of online contrast tools or paintings with unbiased insurance retailers who can provide prices from more than one company.

Pick a provider:

once you’ve compared charges and diagnosed some potential insurance providers.

Company everyone based totally on factors including insurance alternatives, customer support reputation, economic balance, and to-be-had reductions.

Pick the issuer that offers the coverage you want at a price you may manage to pay for and that you feel comfortable entrusting with your insurance needs.

Overview of the policy:

Before finalizing your vehicle insurance application, carefully assess the policy files supplied via the insurance business enterprise.

Take note of the coverage limits, deductibles, exclusions, and any extra phrases or situations.

Make sure you recognize what is included and what isn’t to avoid surprises down the street.

Submit Required Documentation:

depending on the coverage company and national regulations, you may want to submit extra documentation along with your application.

This could include evidence of identification, automobile registration, or proof of previous coverage.

Observe the commands provided with the aid of your insurance corporation to ensure a smooth application method.

Make payment:

As soon as your utility is accredited, you may want to make the initial fee to spark off your car coverage policy.

This could normally be done online, over the telephone, or by way of mail, depending on the charge options provided by the insurance company.

Be sure to preserve a document containing your charge confirmation for your records.

Acquire affirmation:

After making the payment, you may receive affirmation of your car coverage insurance.

This may come in the form of electronic mail, paper files dispatched via mail, or access to an internet portal wherein you can view and manage your coverage.

evaluation of the affirmation to make sure that each piece of information is accurate, and speak to your insurance provider in case you are aware of any discrepancies.

The Vital Role of Car Insurance in the USA

automobile insurance plays a vital function within the U.S. of the United States, serving as a cornerstone of economic safety for drivers and groups alike.

From making sure individuals can provide you with the cash for protection after injuries to safeguarding in opposition to felony responsibility claims, the significance of car insurance can’t be overstated.

let’s delve into the multifaceted feature that automobile insurance performs in the US of America.

economic protection for drivers:

one of the number one capabilities of car insurance is to offer financial protection for drivers.

In the event of a coincidence, car insurance allows coverage of the costs of automobile preservation or alternative.

Clinical charges for accidents sustained by using drivers and passengers, and asset damage introduced to others.

without insurance, those fees may spiral out of management, main to financial problems for humans and families.

Prison Requirement:

In most states, wearing vehicle coverage is a jail requirement.

country prison pointers mandate minimum stages of insurance that drivers ought to convey to legally perform an automobile.

This requirement guarantees that drivers have the monetary means to cover the damages they’ll cause others in injuries.

Failure to comply with the legal guidelines can bring about fines, license suspensions, or maybe a felony motion.

safety closer to liability Claims:

vehicle insurance additionally protects drivers from legal responsibility claims filed by way of others who suffer damage or asset harm in injuries they motive.

liability coverage covers the fees of felony fees, court docket settlements, and judgments if the insured motive force is observed to be at fault.

Peace of mind for drivers :

This peace of thought shall we drivers recognition on the street and their day-by-day activities without undue worry about the capacity economic outcomes of injuries.

selling responsible the use of conduct:

vehicle insurance incentivizes responsible the usage of conduct via supplying discounts and rewards for relaxing the use of behavior.

Many coverage organizations provide reductions for keeping a clean riding record, finishing protective riding publications, or installing safety talents in motors.

via cozy driving practices, automobile coverage contributes to ordinary road safety and decreases the chance of accidents.

Supporting corporations and economies:

The huge availability of automobile insurance contributes to the stableness and resilience of groups and economies throughout the us.

By supplying financial safety for drivers and agencies, automobile coverage allows the mitigation of the economic outcomes of accidents and guarantees that individuals can recover and maintain collaboration inside the staff.

For more details and related posts please visit here apkinfos.com

Best Car Insurance Advertising in the USA